For a currency that once approached $3 trillion in global market cap, cryptocurrency is nothing if not volatile. In February 2021, a CBS News Money Watch report suggested there were some 100,000 Bitcoin millionaires. A few months later, Crypto.com ran an ad featuring Matt Damon’s famous “Fortune favors the brave!” tagline.

Nothing but clear blue skies, it seemed.

Then of course, the market took a big dip. As one writer famously observed, if you’d listened to Damon and invested $1,000 in Bitcoin, your investment would now be worth a paltry $375. By some estimates, the great crypto crash of 2022 wiped out 80,000 Bitcoin millionaires.

Of course, most investors in cryptocurrency are institutions, not individuals. Still, the recent downward swings in the cryptocurrency market have a lot of people wondering about the future of this objectively fascinating technology.

In this blog post, we’ll take a step back to look at what led up to this particular point in crypto’s peculiar history. We’ll also examine what the industry experts are saying (including our own) about how the future of crypto might shape the broader landscape for digital payments.

Quick Refresher: What is Cryptocurrency?

Here’s a tidy definition of Cryptocurrency from NerdWallet: “a digital asset that can circulate without the need for a central monetary authority such as a government or bank. Instead, cryptocurrencies are created using cryptographic techniques that enable people to buy, sell or trade them securely..”

Then there are stablecoins, such as Tether and USD Coin. Stablecoins are a subset of cryptocurrencies tied to another cryptocurrency, perhaps, or a government-backed asset (such as precious metals), with the purpose of regulating price and supply.

Cryptocurrencies run on blockchain, which is a form of distributed public ledger. Blockchain can be used in a variety of scenarios, such as loyalty programs and supply chain management. Not all blockchains feature a coin or token, though all of them can.

Why Has the Cryptocurrency Market Hit the Skids (and What Happens Next)?

While Bitcoin and Ethereum comprise approximately 60% of the total cryptocurrency market, there are thousands upon thousands of coins and tokens. Some trade at cents on the dollar. Others trade in the thousands.

It’s not surprising that the market regularly encounters peaks and troughs. The 2018 cryptocurrency crash comes to mind, for one.

That said, the most recent meltdown is a bit different. For one thing, H1 2022 was the worst first half of a year in the cryptomarket’s entire short history. The severity of the decline has prompted a twofold response from the U.S. federal government: the first, an Executive Order on Ensuring Responsible Development of Digital Assets; the second, a Framework for International Crypto Regulation set forth by the U.S. Treasury.

Both unprecedented, at least with respect to cryptocurrency.

As to the cause of crypto’s recent slide, it’s important to remember that most people still consider this a risky asset. In a column published by NPR, one economics professor from Cornell characterized crypto as “speculative financial assets.”

Which means they’re quite prone to external market conditions. Robert Brunner, associate dean for innovation at the Gies College of Business at the University of Illinois Urbana-Champaign, points to a recent environment characterized by low interest rates and easy access to capital, which led many to “chase high yields.”

Brunner agrees that today’s environment, in which inflation and interest rates are on the rise, is severely affecting the cryptocurrency market. Yet he doesn’t go so far as to say the crypto bubble has popped. Today—right this moment—Bitcoin is up 180% and trading at more than $21,000 per coin.

Indeed, it appears that cryptocurrencies and blockchain technology are here to stay, despite recent meltdowns. There’s just too many use cases in play that go far beyond the value of how Bitcoin fares at close of market. Still, there will be more crashes. Even Dan Morehead, head of a crypto-only hedge fund, agrees that more dips are highly likely.

One wonders, too, what impact those dips have on the 16% of U.S. adults who say they’ve invested in cryptocurrency individually.

How Does Crypto-Volatility Affect Digital Payments?

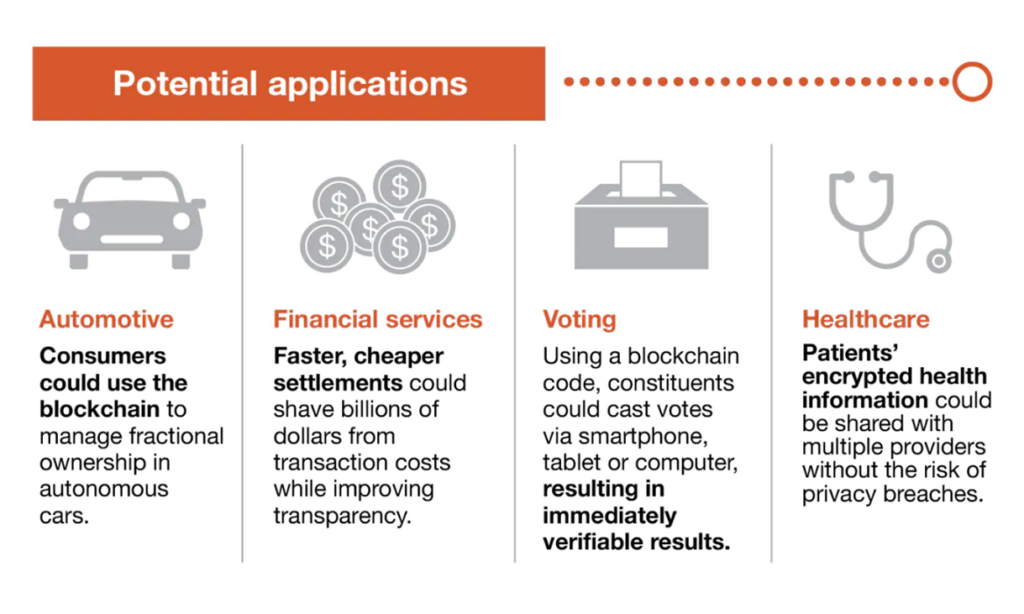

Frankly, this is a big, baggy question with big, baggy answers. We’ve noted two of many applications for blockchain technology. PwC adds four potential applications of blockchain worth noting:

Even if blockchain, the technology that backs all cryptocurrencies, somehow collapsed, the AppTechs of the world wouldn’t go anywhere. We’ve looked into a variety of partnerships with digital asset platform partners for blockchain and cryptocurrency use cases, and we’ll continue to do so.

Then there’s the question of whether this latest crypto-meltdown will be the last. Will people still use Bitcoin, Ethereum, and the rest? Again, our APIs will still support cryptocurrency payments and crypto-payments invoicing regardless of which coins come in and out of vogue.

“At AppTech Payments Corp., we firmly believe that Cryptocurrencies are here to stay and continue to represent the evolution of global commerce,” says Ben Jenkins, Chief Technology Officer. “We’re firmly rooted in building seamless commerce experiences that will support all current and future transaction technologies.”

Closing Thoughts: While Investors Might Live and Die by Crypto, Omni-Channel Payment Platforms Do Not

We’re still as excited about the blockchain and crypto as the next person. We’re monitoring the recent crash of the crypto market, too, along with other aspects of the broader world of blockchain. The good news is that our work with embedded payments is much more about how and where people transact than it is a particular currency.

This of course is the beauty of headless APIs, which promise to remain important to retail and commerce no matter how the crypto market goes.