When a commerce transaction just works—when it’s easy and effortless—it feels like magic. Wait, I can pay with my smartwatch at the cash register? Yes, you can. Only it’s not magic. In reality, that sort of effortless commerce experience is carefully orchestrated by one of two types of commerce platform:

Legacy Commerce Platforms vs. Headless Commerce Platforms | |

Legacy:

| Headless:

|

Traditionally, commerce platforms and the frontend customer experiences they enable have been tied together under one roof. These are the monolithic systems and trusted legacy platforms of the world—you probably know and use a few today.

Now, customers want the power to make purchasing decisions when they want, how they want. And it’s difficult to keep up with the proliferation of new digital experiences when your frontend technology is bogged down by the backend.

Hello, headless APIs for commerce.

What’s Driving the Market for Headless APIs?

Digital proliferation is a primary driver behind the rise of headless APIs in commerce. The sheer volume of devices, apps, and experiences seems to expand every day. Take the Internet of Things (IoT), for one: by some estimates, the number of connected IoT devices in use will surpass 75 billion in 2025—three times the number in 2019.

That means commerce transactions can happen almost anywhere.

This creates a distinct challenge for legacy commerce platforms, which often fail to keep up with fast-evolving consumer demands. What’s more, legacy systems ask an awful lot of their keepers. According to a 2019 State of the Developer Report, 60% of developers said that maintaining a legacy system hindered their productivity.

Many commerce businesses are finding they simply cannot afford such a high-touch, high-cost commerce platform—especially given such intensely shifting consumer demands.

What is Headless API in Commerce?

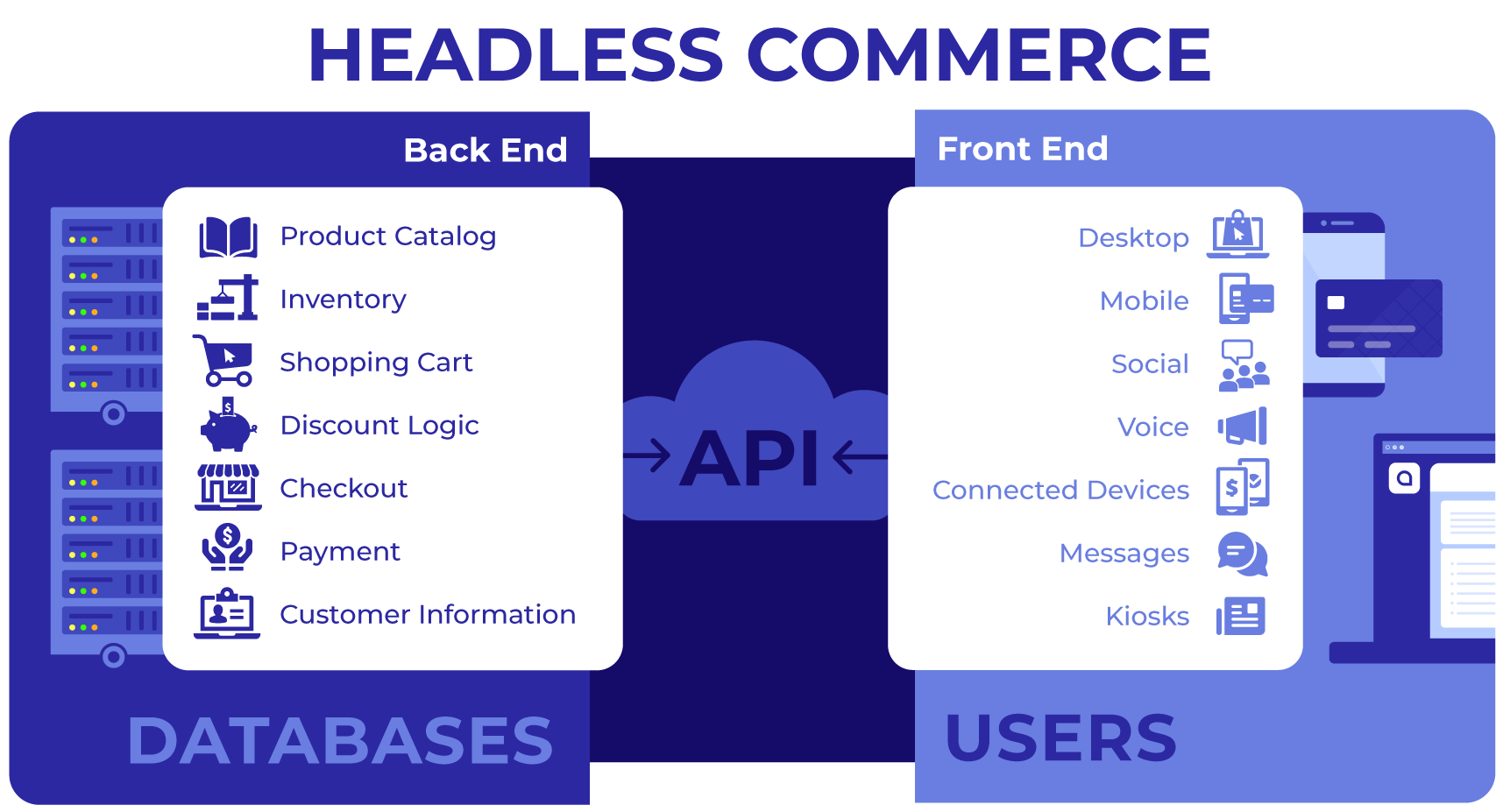

On the other hand, a headless API separates the frontend and backend of a commerce experience. While the backend handles things like database, web server, and fulfillment, an API brings your content, products, and payment experiences to a variety of different screens and devices.

For example, if you want to enable customers to purchase new water filters directly from their smart refrigerator, or you need to launch split-payment functionality in response to surging demand, a headless API will be the fastest distance between points A and B.

Advantages of Headless APIs in Commerce

- Very few dependencies on legacy commerce systems, carts, and checkouts

- Customers can complete purchase from any screen or device

- Faster time to market when launching new features, payment experiences, regions, channels

- Secure integrations for third-party payment options

- More agile testing for new offerings, promotions, discounts, and user flows

- Comparatively lower development costs

Perhaps the most distinct advantage is that of improved customer experiences. Customers don’t need to know about everything going on under the hood that makes it possible to pay their contractor’s invoice by text message. They don’t care about the multiple API calls going from the presentation layer to the backend—about the progressive web applications (PWAs) and microservices that allow the payment to happen so seamlessly and securely.

Customers only care that they can make payments when and where they want to, without friction. This is where headless API shines.

An Interesting Use Case for Headless API-Enabled Payments

By 2024, digital and mobile wallets will account for more than 50% of all global e-commerce payment transactions. What’s that have to do with headless APIs? Well, if you can’t quickly spin up the payment method of choice—digital and mobile wallets, for most people—your conversions might dip.

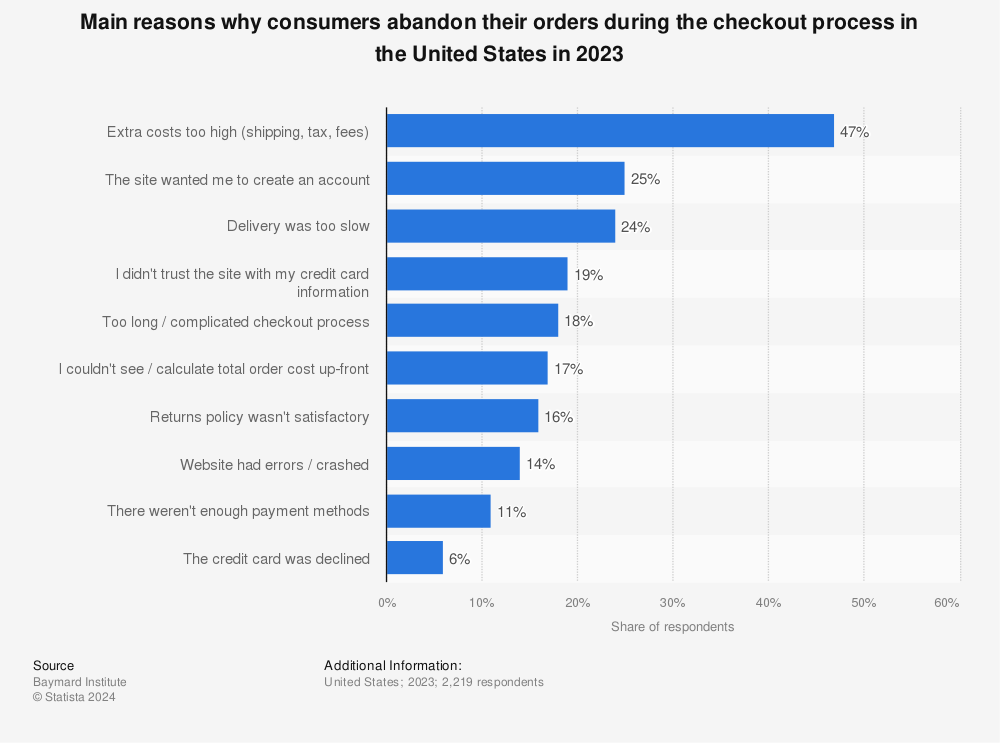

Take cart and checkout experiences. In 2021, 25% of U.S. consumers who abandoned their cart did so because they were asked to create an account. Another 18% said the checkout process was too complicated. And 7% abandoned their cart because there weren’t enough payment methods.

Find more statistics at Statista

Some of this friction is avoidable thanks to headless APIs. For example, headless APIs can enable one-click or “buy now” checkout in a variety of channels. That way, when a consumer sees a pair of shoes they like on a Facebook ad carousel, they can complete the transaction right then and there.

This is just one example of how much easier it is to deploy a new front-end payment experience using headless APIs, compared to a legacy system. This deployment speed can lead to improved conversions, increased revenue, and reduced platform costs.

In the End, it’s the Most Scalable Solutions that Will Shape Commerce

Is headless architecture perfect for commerce? Of course not. Heavy is the head that wears the crown. Despite the upside of frontend experiences that your developers dream up in-house, building, maintaining, and troubleshooting those experiences can be resource-intensive.

But not as resource-intensive as it is to make platform-wide updates each time you need to roll out new experiences. It’s just not scalable, and the costs of being unable to scale commerce experiences due to legacy platforms far outweigh the cost of maintaining those powered by headless APIs.

Emma Wibly, Chief Financial Officer at Snoop, said it best in The FinTech Playbook: Structuring for scale:

“If your payments’ volume is growing 5x in the next year, can your infrastructure support that without falling over, is it cost efficient at that scale, and will your internal controls pick up issues in a timely manner? […] When building a business in a scaling environment, I always ask myself, does this activity still make sense at 10x the volume? If the answer is no, it’s time to rebuild.”

Can your commerce platform keep up with where your business will be a year from now?