At this point, it might feel like we’re stating the obvious to say payments are everywhere. To be fair, your hip aunt just paid for her Starbucks with her smart watch. The Joneses down the street use their refrigerator to order fresh groceries and watch live television. Soon, your car itself will become a wallet on wheels.

So, yeah: payments really are everywhere.

Not surprisingly, embedded payments comprise a critical part of these experiences. So much so that JP Morgan estimates embedded payments account for $1.1 trillion in global payment volumes. In speaking with our own customers, we’ve found that an embedded payment solution is an important competitive differentiator, especially when pursuing clients that want to improve customer experience while boosting revenue.

That said, what exactly are embedded payments? And where do they currently fit into the payments landscape moving forward?

How Embedded Payments Work

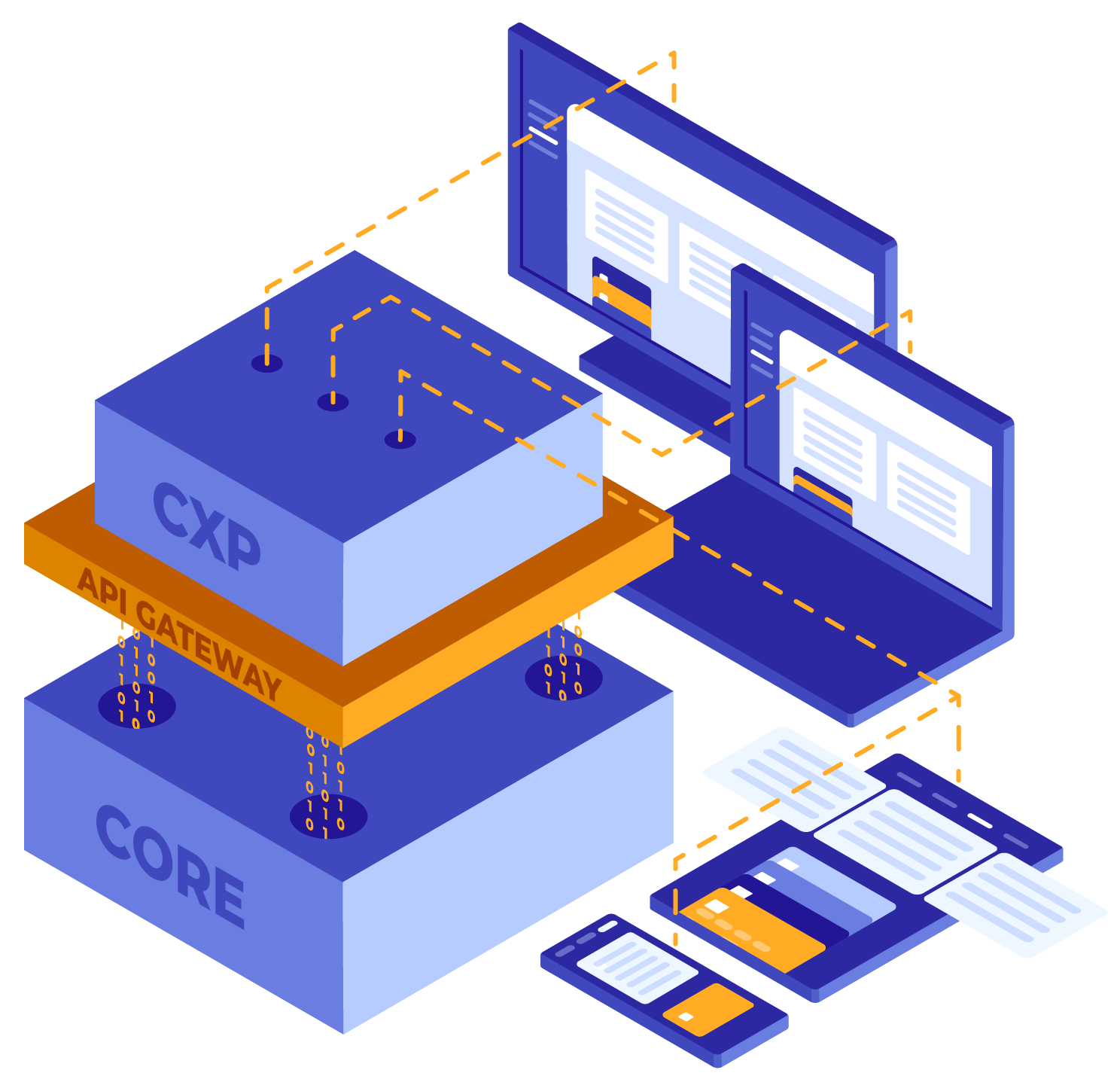

From the consumer perspective, embedded payments allow for the convenient, in-the-moment transactions that have now become commonplace. We already mentioned wearables, smart refrigerators, and the like; but even newer experiences like text-to-pay and embedded financial products are made possible by embedded payments APIs.

From the business perspective, embedded payments are a bit more complex. For a given embedded payment experience, companies must successfully orchestrate the payment process between merchants, aquirers, and financial institutions—not to mention fraud checks, compliance, and network acceptance. For larger organizations with myriad embedded payment experiences, the scale of processing these payments increases by orders of magnitude.

In a nutshell, embedded payments are: when a customer makes an embedded payment on an e-commerce platform, for example, the AppTech API can automatically route that payment to the customer’s bank and facilitate fraud prevention with third-party compliance providers.

What Are the Advantages of Embedded Payments?

Embedded payments are one of the five “payment mega-themes” identified by JP Morgan. Ostensibly, these are the themes that will shape the payments landscape moving forward. The other four are:

- Platforms, or all-in-one payment ecosystems (e.g., Stripe)

- Online, or e-commerce and other online economies

- Wallets, or mobile transaction apps

- Real-time, or consumer demand for instant transactions

The following video from JP Morgan provides a more thorough overview of each theme:

As for why a recent report from OpenPayd found that 83% of organizations “plan to offer embedded payment to customers within the next five years,” we see a few first-hand explanations. It’s what customers want, for one thing. Then of course there are the new revenue streams and improved customer experiences that may result. Here are a few other advantages of embedded payments:

- Improved agility and scalability

- Stronger customer relationships

- Access to new customer bases

- Potential for new partnerships

- Less need to manually integrate payment options

- Faster time to market for new payment experiences

- Better success rate for failed transactions

The truth is, every business needs to collect and move funds, and embedded payments make it an easier and more transparent process. Your customers and your customers’ customers expect the same great experience they would have when ordering food with DoorDash, for example, or an Uber. That’s true regardless of the vertical you’re in.

Embedded payments give more control to users and providers alike. By taking third-parties out of the equation, software companies can increase margins and give customers more visibility into their transactions. Reducing reliance on other companies makes it easier to control the customer experience and resolve issues quickly, leading the way to customer loyalty.

The idea is to embed a centralized payment experience into the existing software stack to provide a seamless inline flow to customers. Providers that begin strategizing and investing in these capabilities now will be poised to stand out from the competition in a few and sustain long-term growth.

What the Analysts and Experts Say About Embedded Payments

Unsurprisingly, many organizations, from banks to software providers, are trying to pivot rapidly with varying degrees of success. Goldman Sachs made headlines when it expanded investments in embedded finance strategy, one of many such examples. Here’s what some industry analysts are saying about embedded payments.

McKinsey & Company

In a recent Insights piece, Zac Townsend, Associate Partner at McKinsey & Company, describes six trends to watch in the embedded finance space. Townsend makes particular note of the ability of automation and APIs to “scale BaaS faster, putting embedded finance within reach for more companies considering it.”

Gartner

In Three Evolutions of Digital in Financial Services, Michael Horney, Principal in Advisory with Gartner, describes one interesting evolution: embedded financial relationships. As Horney points out, “instead of providing financing options for new furniture after a customer purchases a house, leading firms will recognize that a customer is looking to buy a new home and proactively offer financing options before the purchase.”

Forrester

Jacob Morgan, Principal Analyst at Forrester, articulates what his firm calls the payment fabric, with a notable statement on embedded payments. “Forget embedded payments — the story becomes one of embedded payment technology, as today’s fragmentation gives way to orchestration and re-bundling and successful payment firms offset complexity with scenario-based solutions.”

Accenture

In “Disruption and opportunity in digital payments,” Accenture’s Sulabh Agarwal, Managing Director – Global Payments Lead, and Dominika Bosek-Rak, Research Specialist, remind us that 2.7 trillion transactions will move to digital payments, worth some $48 trillion. “The winners are the banks that are proactive about deciding where and how they want to win. Now is the time for banks to define what role they want to play in the future payments ecosystem—before someone else decides it for them.”

IBIS Intelligence

Writing for IBIS Intelligence, Kristian Gjerding, CEO of CellPoint Digital describes some of the technical advantages for what he calls payment orchestration platforms. “A payment orchestration provider redresses this imbalance by transferring control of the transaction flow back to the merchant by allowing them to create real-time rules for switching transactions and offering APMs to consumers. This dynamic routing improves the success of processing rates, gives customers more payment options, and means failed transactions can be re-routed to the next acquirer leading to fewer lost sales.”

Last Word: Expect More Demand for Embedded Payments, While Demanding the Very Best

Evidently, the shift to integrated and embedded payments will continue at speed, as will the arrival of ever more providers. As the bulk of analysts and industry experts point out, the organizations that get agility and scalability right—while ensuring the utmost security and compliance—will be in the driver’s seat.

We’ve written elsewhere about the tremendous power of headless APIs to build fully branded and customizable experiences. Our own RESTful API supports tokenized, multi-channel, and multi-method transactions. This allows for the class of embedded, highly secure digital payments and banking platforms your customers are looking for. As the demand for category-best solutions continues to swell, AppTech will remain committed to leading innovations for the embedded payments market.