Powering

Commerce

Experiences™

“We are the leader in Specialty Payments™ focusing on building custom eco-solutions using our patented technologies.”

-Luke D’Angelo, Chairman & CEO.

“We are the leader in Specialty Payments™ focusing on building custom eco-solutions using our patented technologies.”

-Luke D’Angelo, Chairman & CEO.

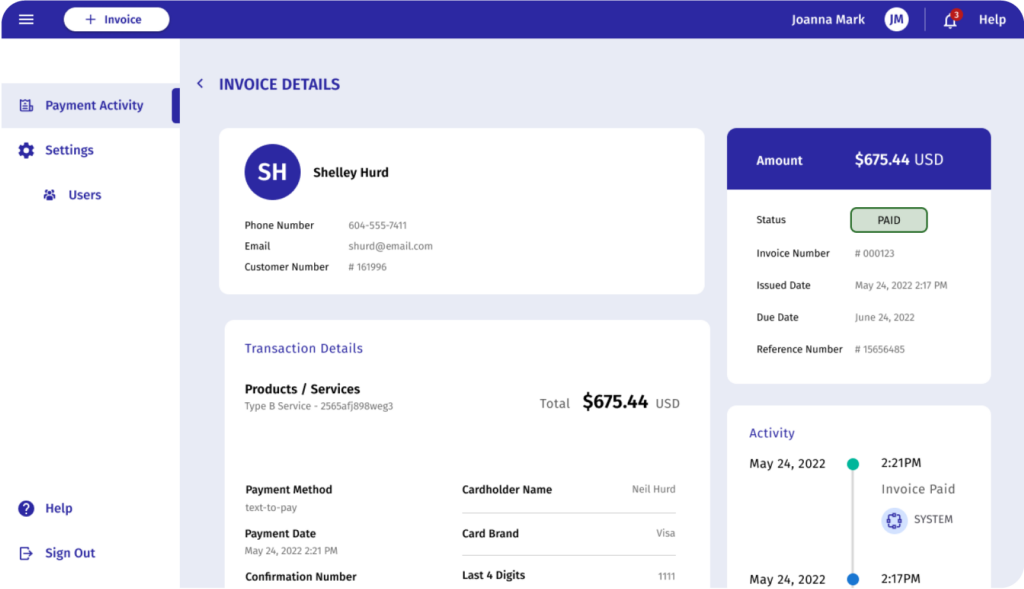

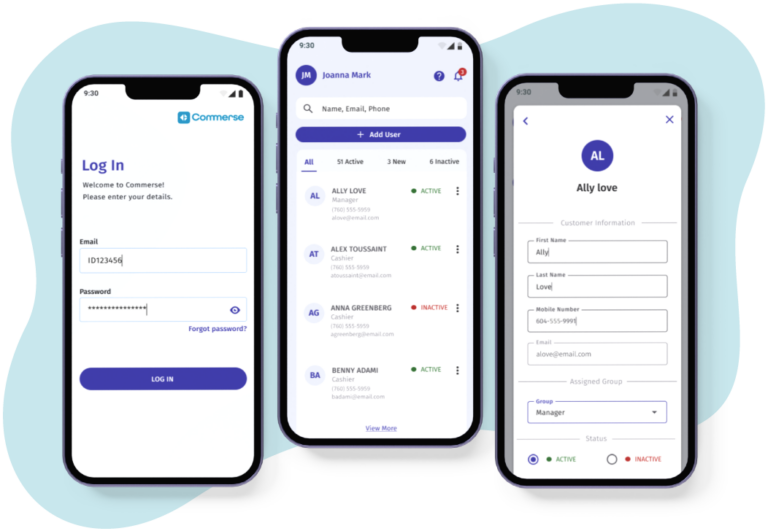

Commerse™ provides businesses with everything they need to accept digital payments including credit card and alternative payment processing services.

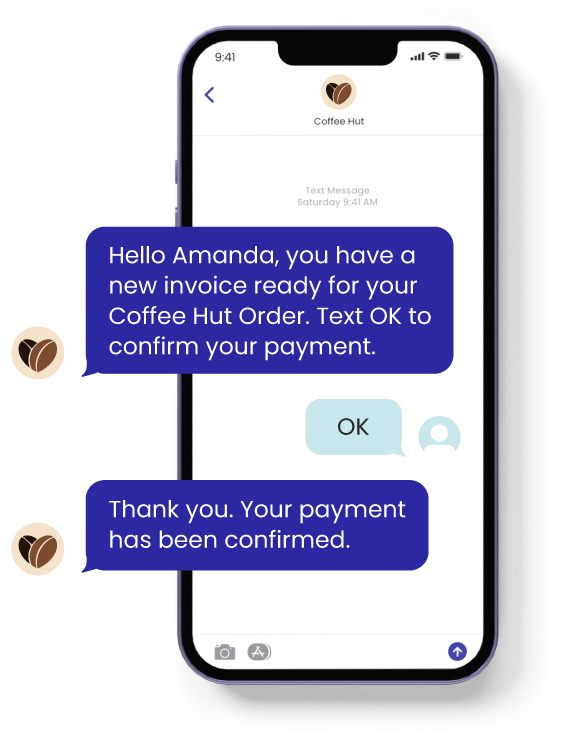

Utilize Commerse to enable SMS payment and invoicing capabilities that simplify and streamline payment acceptance and customer choice.

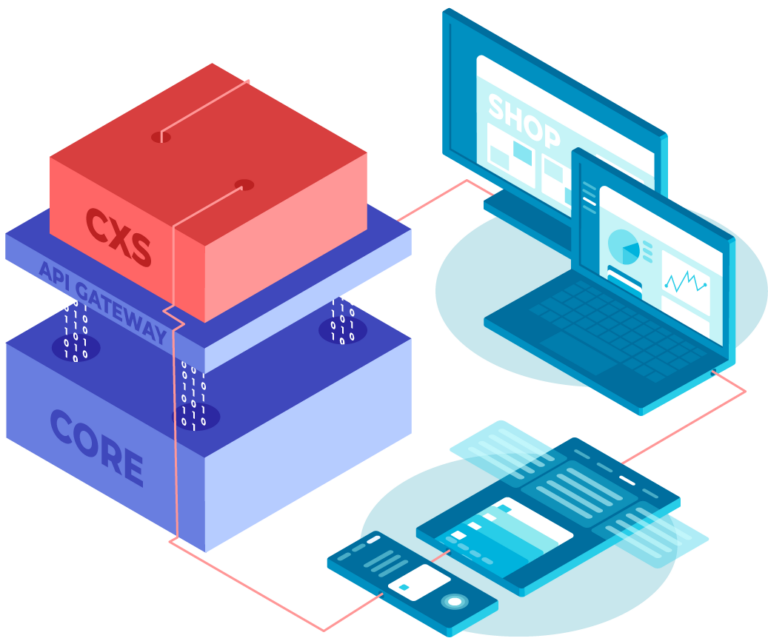

Backed by an intelligent and secure digital financial technology stack and architecture, Commerse is built to enable payments and banking innovations for nearly any business or use case.

Best-of-breed cloud and edge security solutions are integrated with Commerse™ to ensure our solutions provide maximum protection including GDPR and PCI without impacting performance and the overall user experience.

Keep up with the latest news.

Access documents filed with the SEC.

Discover why our patent portfolio is industry-shaping.

“AppTech has been our payment processing vendor for quite some time now. Their rates and fees were lower in every category than the vendor we were using. Their ability to assist us in both our face-to-face transactions and our e-commerce processing has been extremely helpful. Their attention to detail and willingness to help with any situation that comes up makes them a valuable asset.”

“AppTech Merchant Services is a reliable, low-cost payment provider that I can recommend to my e-commerce clients. It's easily integrated into shopping carts and custom scripts using their APIs. Technical support is always helpful when I do have questions during development."

"AppTech consistently has excellent customer service, and I am always very impressed with how fast they are able to help assist me by both phone and email - especially someone like me who has minimal knowledge about the industry and always asks A LOT of questions! Last year I changed the name of my business which was a bit of a headache, to say the least, thankfully the Team was able to help me transfer smoothly and without any added stress. I have recommended AppTech Payments to everyone that asks about my processing company and will continue to do so - I honestly would never go with another company! Thank you, AppTech!”

Input your search keywords and press Enter.