The staying power of digital payments is yesterday’s news. More than 75 percent of people in the United States use some form of digital payment, and 58 percent use two or more forms of digital payment. The number of P2P mobile payment users alone is expected to surpass 159 million in 2023, before eclipsing the 180-million mark by 2026.

The continued penetration of mobile-to-mobile payments makes one thing plain: people are in the driver’s seat when it comes to how they pay. Consumers and the business they patronize now define the rules of engagement. What’s emerged is a faster, more convenient marketplace where people can eliminate the process of cutting checks just by sending a text message—wherever and to whomever they please.

Which was precisely the genesis behind the very technology that in large part makes P2P payments possible.

The Patent That Helped Start it All: Mobile-to-Mobile Payment System and Method

You might say that AppTech co-founder Mehrak Hamzeh saw it all coming. He’s the inventor of the Mobile-to-mobile payment system and method (aka US8369828B2). We strongly believe that this very patent gave rise to the P2P payments industry itself by opening the door to moving money by text message, click, tap, or scan.

With this patent, Hamzeh and his team addressed the pressing need for a convenient, low-cost way for people to pay and accept payments with their phones. Of course, the eligible devices go beyond smartphones. And the use cases for this technology extend beyond P2P pay-by-text scenarios, to include business-to-business (B2B), a business-to-consumer (B2C), and consumer-to-consumer (C2C) payments—and not just with smartphones.

The patent lays out a few key scenarios for mobile-to-mobile payments that we’d like to color in with the real-world applications they enable today.

Scenario 1: Paying a Friend Who Picked Up the Tab (C2C)

The peer-to-peer payment scenario is perhaps the most ubiquitous today. “What payment app do you use?” is now a common refrain, especially in a world where get togethers and rendezvous remain part of our social fabric, while carrying cash increasingly seems so 20th century.

Let’s say friends just finished a fancy steak dinner when one friend realizes that their wallet is in the car—back at home. Their phone, of course, is in their front pocket, which means they can easily text their half of the dinner tab to their friend without missing a beat.

This kind of consumer-to-consumer mobile payment is so common nowadays. And it’s hardly enabled by simple magic. The more likely circumstance is that the friend registered for a text-to-pay program with their digital banking solution. That means they can simply send money via text to their friend—“Pay 555-555-5555”—who can accept those funds without being a member of the same bank.

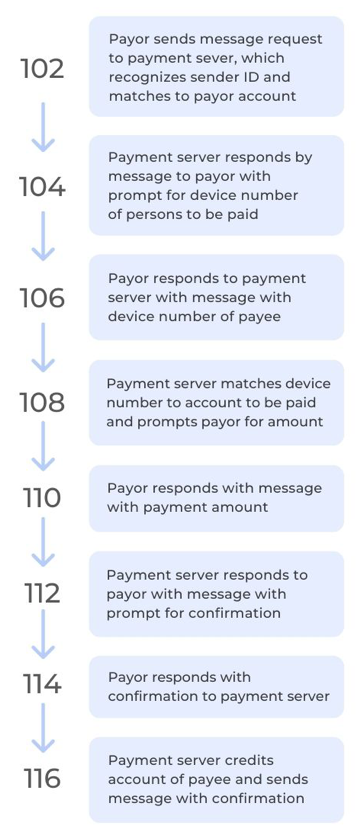

Here’s how the concept works.

Scenario 2: Offering SMS Payments to Mobile Subscribers (B2C)

In the B2C world, in particular, customer experience is everything. Businesses large and small must constantly weigh their own business interests—and how they go about realizing them—with what their customers experience with every interaction. Offering an SMS payment option is in many ways the best of both worlds.

You can imagine the growth potential and reach of this capability. For example, with relative ease and convenience, a large mobile carrier such as (You pick your carrier and fill in the blank) can send a text not only reminding an entire subscriber base that their bills are due, but giving them the option to pay their bill by SMS right then and there.

Of course, businesses of all types can use B2C SMS payments. A yoga studio with regulars, for example, can enroll their members in text-to-pay, as can a gym or salon.

Scenario 3: Construction Firm Alleviates Cash Flow Issue (B2B)

Mobile-to-mobile payment technology has even found its way into B2B transactions. Take invoicing, for example. It’s no secret that building contractors often face cash flow issues due to outstanding and late payments. Walk into the accounts receivable department at a large construction firm and you’ll likely find the team is hard at work tracking down outstanding invoices from property owners, general contractors, and the like.

It’s a problem that extends beyond construction and contractors. That’s why you’ll now find numerous examples of businesses using embedded SMS payments to invoice their customers. It’s convenient and secure, for one thing, allowing customers to pay without disrupting what they’re already doing. From an accounts receivable perspective, SMS payments (or even MMS payments, if forms are involved), can help businesses collect more payments, more efficiently, from more customers.

Closing Thoughts: That Escalated Quickly (and We’re Not Surprised)

The beauty of the mobile-to-mobile payment system and method patent lies in all of the doors it opens. Invoicing someone by text message might not have seemed possible, even back in 2007 when Mehrak Hamzeh first applied for this patent for mobile-to-mobile payments.

Today, we’re seeing a spectacular proliferation of the use cases for mobile-to-mobile payments. That goes for C2C, B2C, and B2B, as our three patent-led scenarios illustrate. Of course, mobile-to-mobile payments represent just one part of the broader transactions landscape.

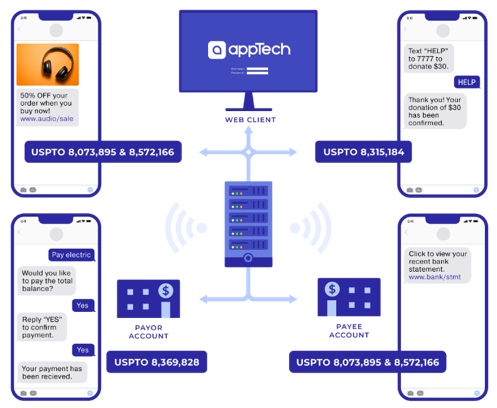

Coincidentally, US8369828B is but one important part of our intellectual property portfolio, which includes patents for Mobile Commerce Framework, System & Method for Delivering Web Content to a Mobile Device, and Computer to Mobile Two-Way Chat System & Method.

No wonder the P2P mobile payment is evolving in so many new and profound ways.